what is credit card: when I first graduated from college, I get to know about credit card but don't know what credit card is? how credit card works? how to use it I know nothing but all the people around me using them fearlessly, so I started doing research and learning about them, it turns out credit cards aren’t so scary after all! And are actually super helpful if you know how to use them properly!

but while I was researching, I had to go through lots of different websites and platforms there isn't a single website where I could learn everything at once, so I decided to write this blog where you get to know everything from how to open a credit card to how to close credit card. let's learn what is credit card and how credit card works.

Before you get started on your credit card journey, you have to know that you must treat credit cards just like cash. If you aren’t careful, you can get yourself in trouble and possibly buried in debt.

what is credit card?

How credit card works?

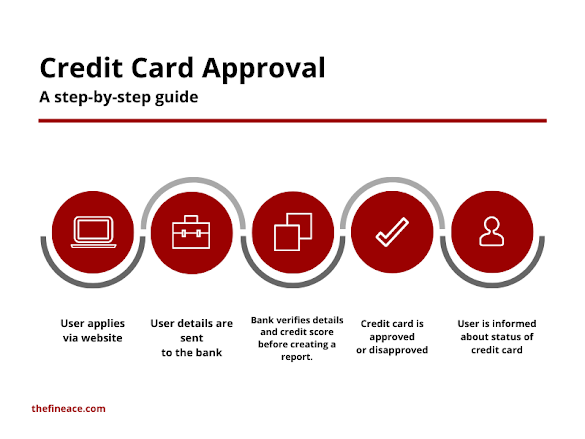

- You apply for a credit card and are approved for a credit limit.

- You make a purchase with your credit card.

- The merchant sends the transaction information to the credit card network.

- The credit card network sends the transaction information to your credit card issuer.

- Your credit card issuer verifies your information and approves or declines the transaction.

- If the transaction is approved, the merchant is paid and your credit card balance is increased by the amount of the purchase.

- You receive a monthly statement showing your purchases, payments, and balance.

- You make a payment on your credit card bill.

- The credit card issuer updates your credit report with your payment information.

Types of credit cards

- Rewards credit cards: offer points or miles that can be redeemed for travel, merchandise, or cash back.

- Cash back credit cards: offer a percentage of your spending back in cash.

- Travel credit cards: offer benefits such as travel insurance, airport lounge access, and points or miles that can be redeemed for travel.

- Student credit cards: are designed for students with limited credit history. They typically offer lower interest rates and annual fees than other types of credit cards.

- Secured credit cards: require a deposit, which is used as collateral in case you default on your payments. They can help you build your credit history.

- Co-branded credit cards: are issued in partnership with a retailer or other company. They typically offer rewards or discounts at that company's stores or on their products or services.

- Store credit cards: can only be used at a specific store or chain of stores. They often offer discounts or rewards on purchases made at that store.

The best type of credit card for you will depend on your individual needs and spending habits. If you travel frequently, a travel credit card may be a good option. If you want to earn cash back on your purchases, a cash back credit card may be a better choice. And if you're a student, a student credit card can help you build your credit history.

- Annual fee: A fee that is charged by the credit card company each year.

- Grace period: The period of time after your billing cycle ends during which you can pay your bill without incurring interest.

- Late fee: A fee that is charged by the credit card company if you miss a payment.

- Minimum payment: The smallest amount that you can pay on your credit card bill each month without incurring late fees or other penalties.

- Overdraft protection: A service that allows you to use your credit card to cover purchases even if you do not have enough money in your checking account.

- Rewards program: A program offered by some credit card companies that allows you to earn points, miles, or other rewards for using your card.

0 Comments